First Class Tips About How To Reduce Debtor Days

Here are a few tips to help you reduce your debtor’s days.

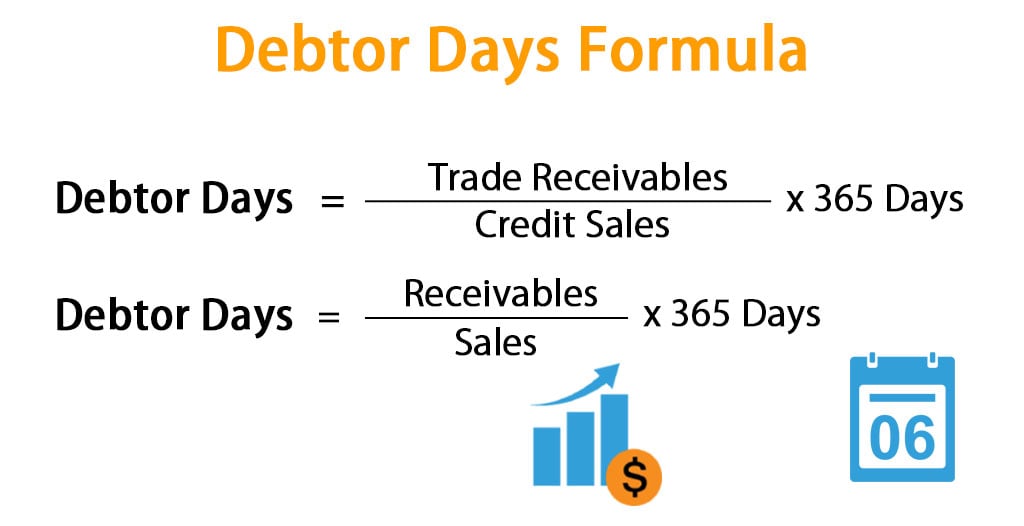

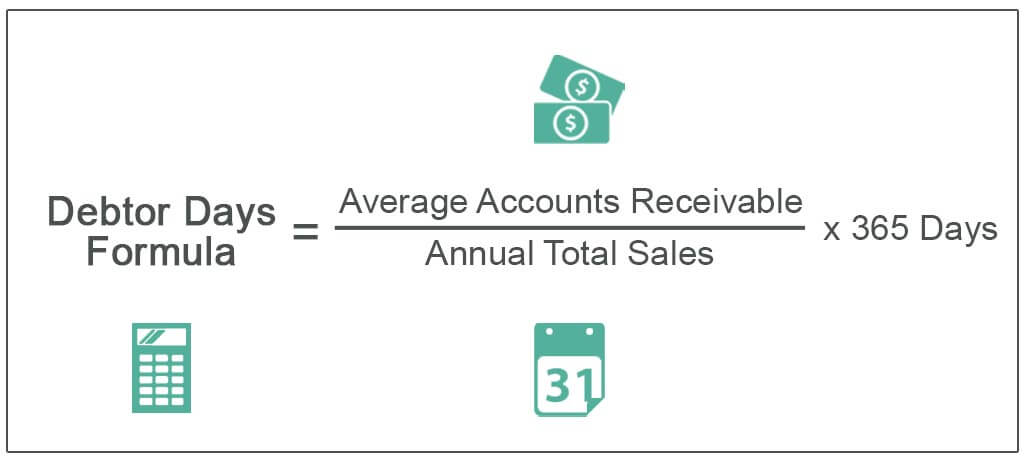

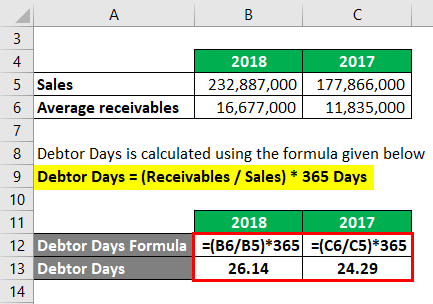

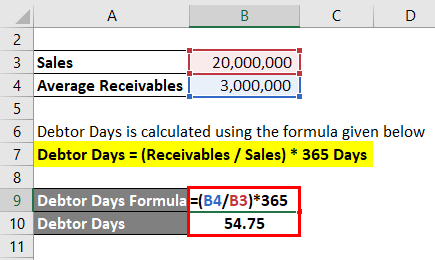

How to reduce debtor days. A third tactic to reduce debtor days is to introduce. Receivable days formula can also be calculated by dividing the average accounts receivable by the average daily sales. The best way to reduce your debtor days is to improve your risk analysis and credit control.

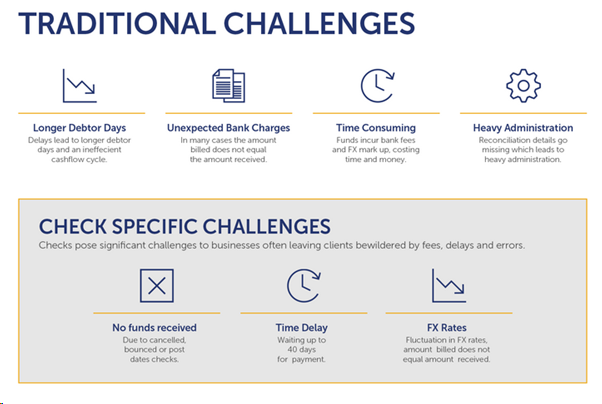

You pick your suppliers based on your. These are my tips to reduce your debtor days: A larger number of debtor days means that a business must invest more cash in its unpaid accounts receivable asset,.

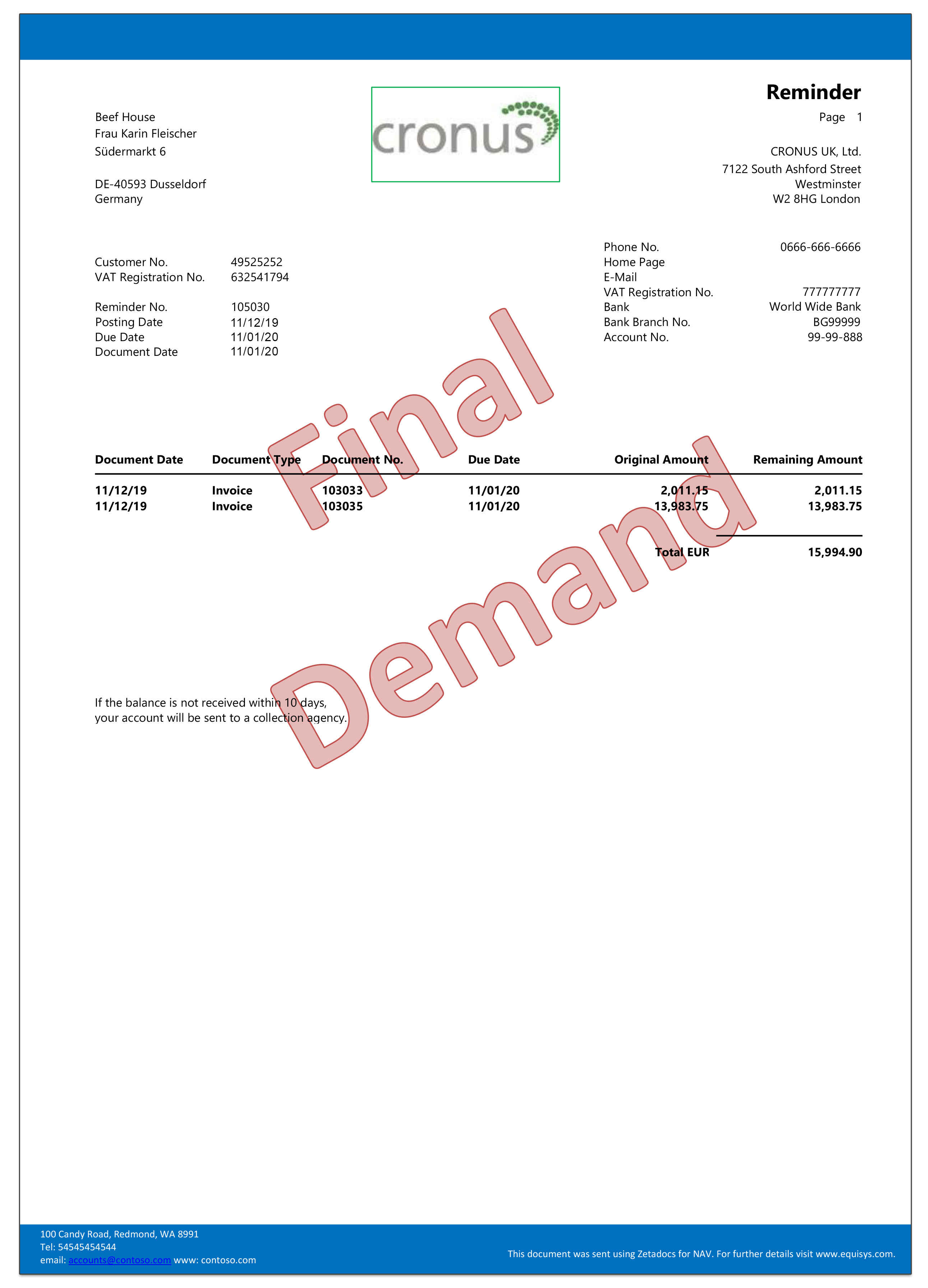

One of the most effective ways to reduce. Make the payment date clear and prominent on the invoice you send. The 7 steps to reducing debtor days step 1:

Do not be shy to negotiate and discuss paymentterms and conditionswith suppliers. Only give credit terms to credit worthy customers. Here ten ways that you can lower your days sales outstanding, which will improve your cash flow.

But will reduce the cash flow critical to your business. Here are 7 ways to do that. 6 ways to reduce your creditor / debtor days 1.

When creating an invoice, think about your messaging. Initially, you choose your suppliers based on your specific need,. Avoid any confusion by issuing clear, straightforward invoices using a template that includes.